Hang Seng index world’s biggest tech loser

]

]

Hang Seng index world’s biggest tech loser

Bloomberg

An index launched a year ago to give investors greater exposure to China’s Internet giants is now the world’s worst-performing major technology gauge.

The Hang Seng Tech Index has been on a roller-coaster ride in the past 12 months. The gauge, which marks its first anniversary on Tuesday, was up 59 percent at its February peak, but has since seen more than US$551 billion in market value wiped out amid Beijing’s clampdown on the sector.

That has reduced its gain to nearly 6 percent, compared with more than 40 percent for the MSCI World Information Technology Index and the NASDAQ-100 Index. The measure also lags onshore peers — the ChiNext Index is up 35 percent for the period.

A man walks past an electronic board showing the Hang Seng indices in Hong Kong on July 7. Photo: AP

The underperformance highlights regulatory risks for one of the fastest-growing sectors of China’s economy. Beijing’s bold moves to rein in the nation’s powerful tech firms, such as Jack Ma’s (馬雲) Ant Group Co (螞蟻集團) and Didi Global Inc (滴滴), have sent global investors fleeing on concerns over China’s tighter grips on data.

“The ongoing concern that medium-term earnings power may be dented by their data becoming more of a public good, and privacy becoming more of an issue, remains a headwind,” Robeco Hong Kong Ltd portfolio manager Joshua Crabb said.

Bank of America Corp strategists wrote in a note last week that the regulatory overhang is unlikely to dissipate any time soon, instead recommending investors to rotate into tech firms outside of China.

Launched last year, the gauge tracks the 30 largest Hong Kong-listed tech firms, including giants such as Tencent Holdings Ltd (騰訊), Alibaba Group Holding Ltd (阿里巴巴) and Meituan (美團). It was set in motion at a time when Chinese tech companies were looking to list closer to home as growing tensions between Washington and Beijing threatened to curtail access to US capital markets.

The index took a fresh beating this month — down 11 percent — after China ordered a ban on new users from downloading Didi’s app. Regulators are considering unprecedented penalties for the ride-hailing company following a controversial initial public offering, people familiar with matter have said.

While the forward price-to-earnings ratio for the Hang Seng Tech Index has slumped from a February peak, it is still trading at about 35 times estimated profits, compared with 28 times for the NASDAQ-100 Index and 43 times for the ChiNext, Bloomberg’s data show.

That has not deterred some. Hong Kong’s two most popular exchange-traded funds this year are those tracking the tech gauge. The combined total assets of all such ETFs have more than doubled in size this year to US$3.8 billion, and the pace of investment into the products has accelerated since mid-May.

“Some long-term institutions may have started buying these Hang Seng tech ETFs. It seems that the more the index falls, the more ETFs they will buy,” Zhongtai Financial International Ltd (中泰金融國際) analyst Alvin Ngan said.

While some see the uncertainty created by the ongoing crackdown as a buying opportunity, others remain wary amid questions over its duration and where it might head next.

Jian Shi Cortesi, a fund manager at GAM Investment Management in Zurich, said the bottom will not be seen until investors have seen the conclusion of tightening regulations.

Hong Kong’s Hang Seng index falls more than 8% in two days as China tech stocks continue to crumble

]

]

SINGAPORE — Hong Kong markets continued selling off on Tuesday, extending losses from Monday. The broader Asia-Pacific markets, meanwhile, were mixed.

The broader Hang Seng index in Hong Kong briefly fell more than 5% in Tuesday afternoon trade before paring some of those gains, eventually closing 4.22% lower at 25,086.43.

The index has fallen more than 8% in just two days as regulatory fears surrounding China’s technology and private education sector weighed on investor sentiment. On Monday, it fell more than 4%.

Hong Kong-listed shares of Chinese tech giant Tencent fell 8.98% while Alibaba dropped 6.35% and Meituan declined 17.66%. The Hang Seng Tech index slipped 7.97% on the day to 6,249.65.

China’s antitrust regulator announced Monday a set of guidelines for food delivery platforms that included paying delivery personnel at least the local minimum wage — a move that could hurt the profits of firms such as Meituan and Alibaba’s Ele.me.

Mainland Chinese stocks also saw sizable losses on the day, with the Shanghai composite down 2.49% to 3,381.18 while the Shenzhen component dropped 3.672% to about 14,093.64. Industrial firms’ profits in China jumped 20% year-on-year in June, official data showed Tuesday. Still, that was a decline from the 36.4% year-on-year increase seen in May.

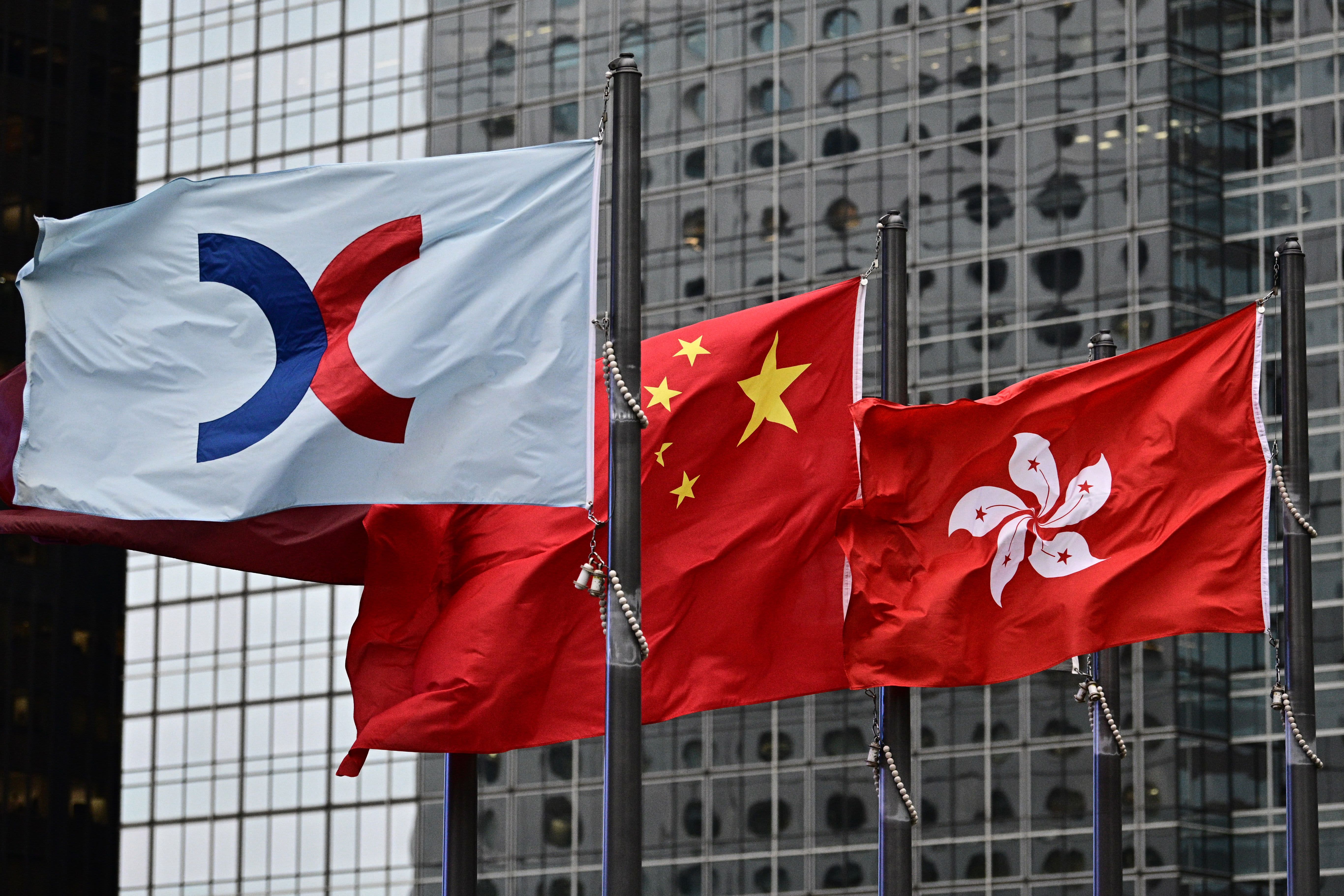

China crackdown makes Hong Kong index world’s biggest tech loser

]

An index launched a year ago to give investors greater exposure to China’s internet giants is now the world’s worst-performing major technology gauge.

The Hang Seng Tech Index has been on a roller-coaster ride in the last 12 months. The gauge, which marks its one-year anniversary on Tuesday, was up 59 per cent at its February peak but has since seen more than $551 billion in market value wiped out amid Beijing’s clampdown on the sector.

That has reduced the gain to nearly 6 per cent as of last Friday, compared to more than 40 per cent for the MSCI World Information Technology Index and the NASDAQ-100 Index. The measure also lags onshore peers: the ChiNext Index is up 35 per cent in the period.

The underperformance highlights regulatory risks for one of the fastest-growing sectors of China’s economy. Beijing’s bold moves to rein-in the nation’s powerful tech firms such as Jack Ma’s Ant Group Co. and Didi Global Inc. have sent global investors fleeing on concerns over China’s tighter grips on data while relations with Washington remain difficult.

“The ongoing concern that medium-term earnings power may be dented by their data becoming more of a public good, and privacy becoming more of an issue, remains a headwind,” said Joshua Crabb, portfolio manager at Robeco Hong Kong.

Bank of America Corp strategists wrote in a note last week that the regulatory overhang is unlikely to dissipate anytime soon, instead recommending investors rotate into tech firms outside of China.

The index plunged as much as 5.4 per cent on Monday as a sell-off in Chinese private education companies deepened after Beijing announced a sweeping overhaul that threatens to upend the $100 billion sector and jeopardise billions of dollars in foreign investment. New Oriental Education & Technology Group Inc. plunged as much as 40 per cent, extending Friday’s record 41 per cent fall.

Buyer Beware

Launched last year, the Hang Seng Tech Index tracks the 30 biggest Hong Kong-listed tech firms including giants like Tencent Holdings, Alibaba Group Holding and Meituan. It was set in motion at a time when Chinese tech companies were looking to list closer to home as growing tensions between Washington and Beijing threatened to curtail access to US capital markets.

The index took a fresh beating this month — down 11 per cent — after China ordered to ban new users from downloading Didi’s app. Regulators are considering unprecedented penalties for the ride-hailing company following a controversial initial public offering, people familiar with matter have said.

While the forward price-to-earnings ratio for the Hang Seng Tech Index has slumped from a February peak, it is still trading at about 35 times estimated profits, compared with 28 times for the Nasdaq-100 Index and 43 times for the ChiNext, according to data compiled by Bloomberg.

Bullish ETFs

That hasn’t deterred some. Hong Kong’s two most popular exchange-traded funds this year are those tracking the tech gauge. The combined total assets of all such ETFs have more than doubled in size this year to $3.8 billion and the pace of investment into the products has accelerated since mid-May.

“Some long-term institutions may have started buying these Hang Seng tech ETFs. It seems that the more the index falls, the more ETFs they will buy,” said Alvin Ngan, analyst at Zhongtai Financial International.

While some see the uncertainty created by the ongoing crackdown as a buying opportunity, others remain wary amid questions over its duration and where it may head next. Jian Shi Cortesi, a fund manager at GAM Investment Management in Zurich, said her fund is underweight technology stocks and prefers sectors with policy support, such as network security.

“The Chinese internet names will find a bottom when investors see the conclusion” of tightening regulations, she said.