Child tax credit portal: How to manage your payments and opt out

]

]

Sarah Tew/CNET

You’ve still got time to make changes to your IRS account for child tax credit payments, but not before the Sept. 15 check arrives. The deadline to make changes for that payment was Aug. 30. Parents who find the monthly payment schedule too complicated – or who’d rather get their credit during tax season next year – can opt out of future payments using the IRS Update Portal. Because access to the portal is essential for managing all your payments and personal details, we recommend taking the time to create an account with ID.me.

In September, you’ll be able to use the portal to amend the number of dependents you have, your marital status and your income. Informing the IRS of those household changes will help guarantee that your family is getting the right amount of the child tax credit, which could be up to $3,600 for each kid spread out between 2021 and 2022. Updating your details is key to making sure the IRS doesn’t send an overpayment, which could then negatively affect your taxes next spring.

The Update Portal also lets you see how your last payment was processed if you’re worried about missing a check. We’ll explain below how to unenroll online if your family wants to defer the partial monthly payments this year. We’ll also tell you a way to confirm your eligibility through an easy IRS tool and how to use a separate portal designed for low-income families to register for the credit. We’ve made recent updates to this story.

How to opt out of the October payments and beyond

The Child Tax Credit Update Portal now lets you opt out of receiving this year’s monthly child tax credit payments. That means that instead of receiving monthly payments of, say, $300 for your 4-year-old, you can wait until filing a 2021 tax return in 2022 to receive the remainder of the $3,600. You can unenroll at any time, but you must opt out at least three days before the first Thursday of the month you’re unenrolling from (here’s a useful list of dates to know). At this point, the IRS says unenrolling or opting out is a one-time action – and you won’t be able to opt back in until late September.

The next deadline to opt out is Oct. 4 by 9 p.m. PT, midnight ET.

You may choose to unenroll from the advance monthly payment program because you’re expecting circumstances to change or if the partial monthly payments will interfere in tax planning. Families that usually owe money to the IRS when they file taxes may want to instead use the full credit next year. Or you might want a larger payout if your household is saving for a big expense.

To unenroll, visit the Child Tax Credit Update Portal and tap Manage Advance Payments. You’ll then need to sign in with your IRS username or ID.me account. (You can create one on the page if you don’t have one.)

After you sign in, if you’re eligible, you’ll see an option to opt out of the payments. The IRS says if you filed jointly on your most recent tax return, unenrolling will only affect your, and not your spouse’s, advance payments. That means both parents need to opt out separately.

How each of the child tax credit portals helps parents

Most families who qualify for the expanded credit don’t need to take any action if they want the advance payments this year. If you already filed a 2019 or 2020 federal income tax return (or used the nonfiler tool in 2020 to register for stimulus payments), you’ll get the credit automatically. And the credit is nonrefundable, so you don’t need income to get it.

The online tools are useful for a variety of reasons. Here’s how they help parents with eligible dependents:

The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving any payments in 2021. You can use it now to view your payment history (including if the money is coming by paper check or through direct deposit) and provide the IRS with your current mailing address and bank details.

A nonfiler portal lets you provide the IRS with basic information about yourself and your dependents if you normally aren’t required to file a tax return. The tool is intended to help low-income households register for the payments.

The Child Tax Credit Eligibility Assistant can help you determine whether you qualify for the advance child tax credit payments. The interactive tool is now available in Spanish and other languages.

What other toolkits and resources are available now? The IRS regularly updates its child tax credit FAQ page and has a PDF with details on the portals. The White House has launched a website for the child tax credit that provides information for families, details about eligibility and more downloadable information.

Checking the status of your payments

Using the Child Tax Credit Update Portal, you can view your payment history and add your direct deposit information if the IRS doesn’t have it from a recent tax return. If the IRS has invalid bank account details, it will send the check in the mail. Families that receive their payments by snail mail should allow extra time for delivery.

The IRS reported that some recipients who received their July payment through direct deposit received the Aug. 13 payment by mail due to a tax agency issue, which is expected to be resolved by the September payment.

Verifying your eligibility online

The new Child Tax Credit Eligibility Assistant allows families to answer a series of questions to quickly determine whether they qualify for the advance credit. This can be helpful for families who haven’t received a letter from the IRS confirming their eligibility. The tool is now available in multiple languages, including Spanish.

In its second month, the 2021 enhanced child tax credit is a financial boost for many families but for others it could spark worries about messy taxes.

How to inform the IRS about income or household updates

You’ll need to let the IRS know as soon as possible if your income or dependents change. Later in September, you’ll be able to indicate changes to any life circumstances since you last filed your taxes, such as a change in income, an addition to your family or a change in child custody status. For example, if you started making more or less money this year, you’ll want to update the IRS about those changes so you can get the correct child tax credit amount.

If you had or will have a new baby this year, it’s important to let the IRS know so you can receive payment for up to $3,600 for that child. The same applies if you’ve adopted a child or gained a new child dependent since you last filed your taxes.

Also, if you’ve gained full custody of your child, you’ll be the parent who receives the money for your kid. Note that parents who have shared custody will not each get a payment. This is important for domestic violence survivors, according to comments during an IRS oversight hearing by Nina Olson, executive director of the Center for Taxpayer Rights. The Child Tax Credit Update Portal later this year “should allow them to enter their change in marital status and also where the children are,” Olson said.

Remember that collecting the money even when ineligible may mean you have to repay the IRS during tax time in 2022. If you’re not sure if you qualify, you can opt out of advance payments to be on the safe side. You’ll collect the child tax credit money during tax time next year.

Sarah Tew/CNET

How families that don’t file taxes are able to get their payments

It’s not too late for low-income families to sign up for advance child tax credit payments. The child tax credit Non-Filer Sign-Up Tool is a way for those who aren’t required to file a tax return to give the tax agency basic information on their dependents. This tool can be used by low-income families who earn too little to have filed a 2020 tax return but who need to notify the IRS of qualifying children born before 2021.

With the nonfiler tool, you’ll be able to electronically file a simple tax form with the IRS with enough information for the agency to determine your family’s eligibility for the advance child tax credit payments. You shouldn’t use this tool if you are required to file a tax return but just haven’t yet. Also, don’t use this tool if you actually filed a 2020 tax return or if you claimed all your dependents on a 2019 return.

To use the tool, families must have had a primary residence in the US for more than half the year. To register, parents should have their personal details on hand, including an email address, Social Security numbers for dependents and a bank account routing number.

Heads-up: The IRS recommends using the portal on a laptop or desktop computer, not on a phone. While the tool is not mobile-friendly, according to The Washington Post, you can access it from a browser on your smartphone. In addition to requiring an email address, you need to know your filing status and other tax-related information, which as a nonfiler you may not have readily available.

The IRS provides some guidance on how to fill out the form as a nonfiler. Note that it can take up to 48 hours for the IRS to confirm your email address – and another 48 hours after submitting your information for the IRS to accept it.

-

To get started, create an account if you don’t yet have one. You’ll need an email address to confirm your information.

-

On the next page – with the heading Fill Out Your Tax Forms – enter your information, including your filing status and details about dependents. Because this portal is an update to the tool nonfilers used to claim stimulus checks, you can add information about those payments, called “Recovery Rebate Credit” on the form. Add your banking information to receive your payments electronically instead of in the mail. Tap Continue to Step 2 when ready.

-

On this page – “E-File Your Tax Forms” – you’ll provide your adjusted gross income, or AGI, and sign the form electronically. (Here’s more on how to do that.) When done, tap the Continue to E-File button to submit your information.

Now playing: Watch this: Child tax credit: Everything we know

How you can help families without a permanent address

The IRS is urging people to share information about the child tax credit with others who don’t have permanent addresses. By doing this, you’re helping make sure families receive the payments they’re eligible for. You can share information about the online portals and resources with them so they know about the programs to help them file a tax return.

Read more on income requirements and age qualifications for the expanded child tax credit.

Delayed tax refunds prevent closure for grieving families during the pandemic

]

]

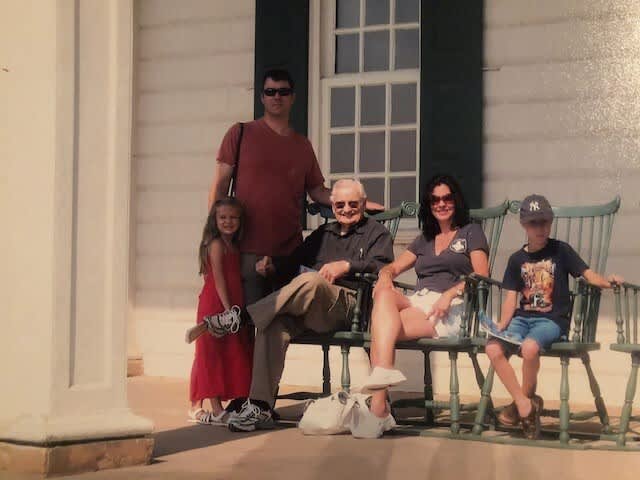

Michele Treacy and family with her late father Col. Lester Marlon Romine Courtesy of: Michele Treacy

Michele Treacy lost her father at the beginning of the pandemic. However, a delayed tax refund has prolonged the grief she and her family are feeling and prevented them from finding closure. Treacy’s father, Col. Lester Romine, 91, passed away at the beginning of March 2020. As he’d named Treacy, 57, his executor, she filed his paper tax return on time in July 2020. She and her three siblings were eager to receive his $2,300 federal refund to finalize and close his estate, yet Treacy is still working with their attorney over a year later. “I promised my dad before he died that I would take care of this for him,” said Treacy, who lives in Kinnelon, New Jersey. “I’m trying to honor his legacy and my promise to him.” More from Personal Finance:

Your tax return preparer may not be regulated. How Congress may change that

Tax refunds and stimulus checks delayed by identity fraud crossfire

Some parents still confused about how monthly child tax credit payments work Treacy’s family is one of the millions with delayed tax refunds this year. By the end of the 2021 tax filing season, the IRS had processed 135.8 million returns, down from 145.5 million the previous year, according to Taxpayer Advocate Service, an independent office within the IRS. Some of the backlog has been caused by the high volume of returns with stimulus payments and other credits needing manual review, Taxpayer Advocate Service reported. But there were still 10.1 million unprocessed individual returns as of Aug. 20, according to the IRS. The agency’s website said returns requiring “special handling” by an employee may take up to 120 days to process.

“It’s been very frustrating for our clients,” said Larry Harris, a certified financial planner and director of tax services at Parsec Financial in Asheville, North Carolina. These snags are common when there’s a final tax return with a refund, he said. While final returns for those who’ve died may follow the same process as those for living taxpayers, Harris said there’s an extra step when a deceased taxpayer has a refund. That’s because these returns include Form 1310, which must be paper-filed, causing further lags. “These situations create a lot of angst for clients when they’re waiting for the refund to close out the estate,” Harris added.

Although many IRS offices were closed due to Covid-19, Treacy called about once per month. She received little information, however, about her father’s pending refund and eventually filed a grievance with Taxpayer Advocate Service. Still, there were no updates, even after checking the status through the Where’s My Refund tool. With millions of overdue refunds, usage for the IRS tool spiked to more than 483 million through May 2021, according to Taxpayer Advocate Service’s mid-year report. However, many taxpayers couldn’t get updates on when to expect their refund or what was causing the delay.

I think it’s fair to say it’s a crisis that really needs some attention. Larry Harris Director of tax services at Parsec Financial

Moreover, the IRS received a record number of phone calls — more than 167 million during the 2021 filing season — and only 7% of taxpayers reached an agent, according to the same report. “I think it’s fair to say it’s a crisis that really needs some attention,” Harris said. The IRS did not immediately respond to a request for comment. Since 2010, IRS funding has been slashed by 19%, according to the Center on Budget and Policy Priorities.

The agency lost more than 33,378 full-time workers between 2010 and 2020, according to its 2020 fiscal year report, and although it has boosted the workforce since 2019, staffing has remained below 2010 levels. President Joe Biden called for $80 billion in IRS funding over the next decade to combat tax evasion. However, the Senate dropped a proposal for $40 billion from the infrastructure bill after pushback from Republicans. Although the Senate’s budget solution framework mentions an offset of “IRS tax enforcement,” it’s unclear whether lawmakers will sign off on the billions of funding Biden proposed.

Finding closure

After tapping her personal accountant for guidance, Treacy finally learned her father’s refund was flagged for fraud due to identity theft concerns. It’s a common issue for estates, said Mary Kay Foss, certified public accountant and CPA faculty at CalCPA Education Foundation in Walnut Creek, California. “With an estate, [the IRS] can’t talk to the deceased person,” she said. “And so when they’re dealing with a third party, they’ve been very cautious it seems.” Although Treacy had filed the necessary forms, such as her father’s death certificate, trust and more, she needed to visit her local Taxpayer Assistance Center to resubmit paperwork, verify her identity and prove she is the executor.

Two weeks after her second visit, Treacy was elated to receive the $2,300 refund check by mail. “I guess the three hours I spent at the taxpayer assistance office helped,” Treacy said in an email. With the refund in hand, she said she has finally reached the final step in the process: working with an attorney to close her father’s estate. One of the issues with prolonged estate closings is the deceased’s assets may generate income. If the estate earns above a certain threshold, the family may need to file another tax return, said Foss. Since the IRS pays interest on tardy refunds, it may bump some estates above the threshold, depending on the size of the return.

There’s no fourth stimulus check from the IRS – here’s how you might get one anyway

]

]

Some people who’ve been wanting to know whether we’ll be getting more stimulus money anytime soon — in the form of a fourth relief check — have arguably been looking for that financial boost in the wrong place.

The federal government is bogged down with a number of catastrophes and politically thorny legislative priorities at the moment. The Biden administration, for example, is trying to call on every drop of political capital it can to push an infrastructure bill over the finish line. Meanwhile, unrelated crises in Afghanistan as well as damage stemming from Hurricane Ida are demanding immediate attention. All of which is to say, finding enough votes in Congress to pass some sort of new stimulus legislation that funds an all-new round of checks anytime soon seems like a mountain that no one has the stomach to climb right now.

Today’s Top Deal

AirPods Pro just hit the lowest price of the month at Amazon! List Price: $249.00 Price: $189.99 You Save: $59.01 (24%) Buy Now Available from Amazon, BGR may receive a commission

Available from Amazon BGR may receive a commission

More stimulus money from states

That’s not to say, though, that there’s not a base of support for this among ordinary Americans. Indeed, a Change.org petition calling for $2,000 recurring stimulus checks for the duration of the pandemic is now up to almost 2.9 million signatures. The thing is, though, just because no new checks will be coming from the federal government anytime soon, that doesn’t mean no new checks are coming at all, from anywhere.

Individual states, themselves, have taken up the gauntlet here. And have begun sending out stimulus checks of their own. Of different amounts, at different times, and to different recipients and demographics.

Here are a few examples.

California

New stimulus checks started going out to California residents on Friday, the result largely of a state budget surplus. The new payments will range from $500 to $1,100, depending on factors including whether the recipients have children. And this new stimulus money is going out automatically. To people who make $75,000 or less and who filed 2020 tax returns.

Texas

Some school districts in Texas are paying employees retention bonuses (which, in the Dallas suburb of Irving, are as much as $2,000). This comes as some school districts around the country have been tapping federal stimulus money to use as a reward for teachers.

New Mexico

A second round of checks for the neediest residents of New Mexico is coming in a “couple of months.”

That’s according to a recent announcement from state officials. And it follows more than 4,000 households in the state getting up to $750 in emergency stimulus aid.

Other states giving out stimulus money

States including Tennessee and Florida have also been pursuing similar efforts here. In the former, state lawmakers approved a 2% raise for teachers statewide then scrapped that in favor of a one-time, $1,000 payment for full-time teachers. $500 is going to part-time educators. And those checks are expected to go out later this year.

Florida, likewise, has been giving $1,000 stimulus checks to teachers. The state is also paying first responders including law enforcement officers and EMTs, among others, up to $1,000. Those payments were intended as a recognition of sorts for their work during the COVID-19 crisis.